PICC Florida Blog

ACV vs RCV – Explained for Insurance Claims

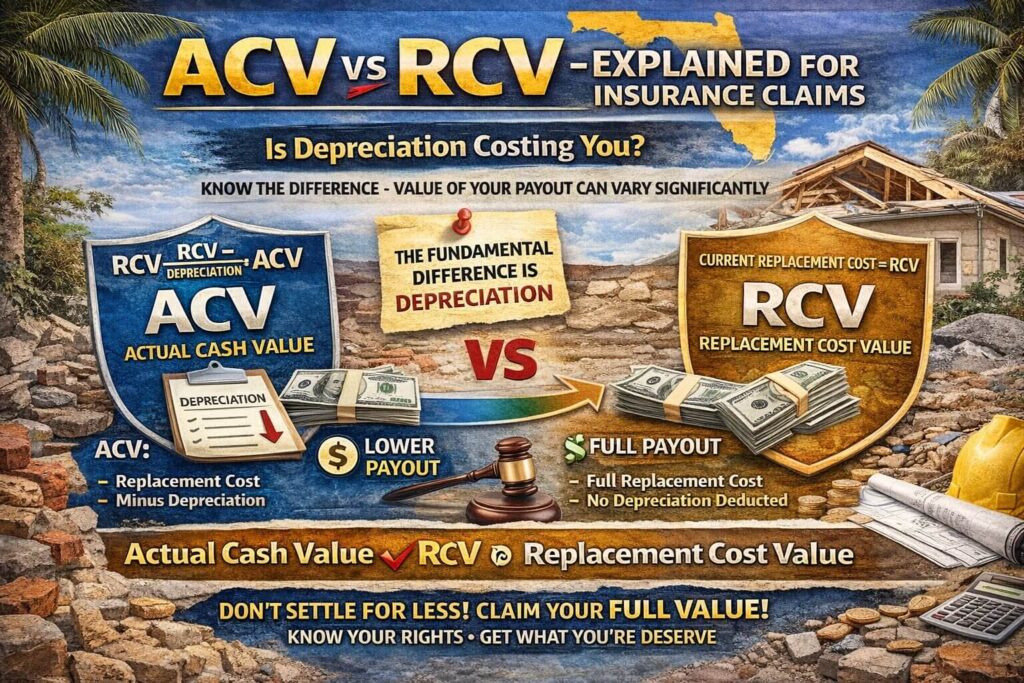

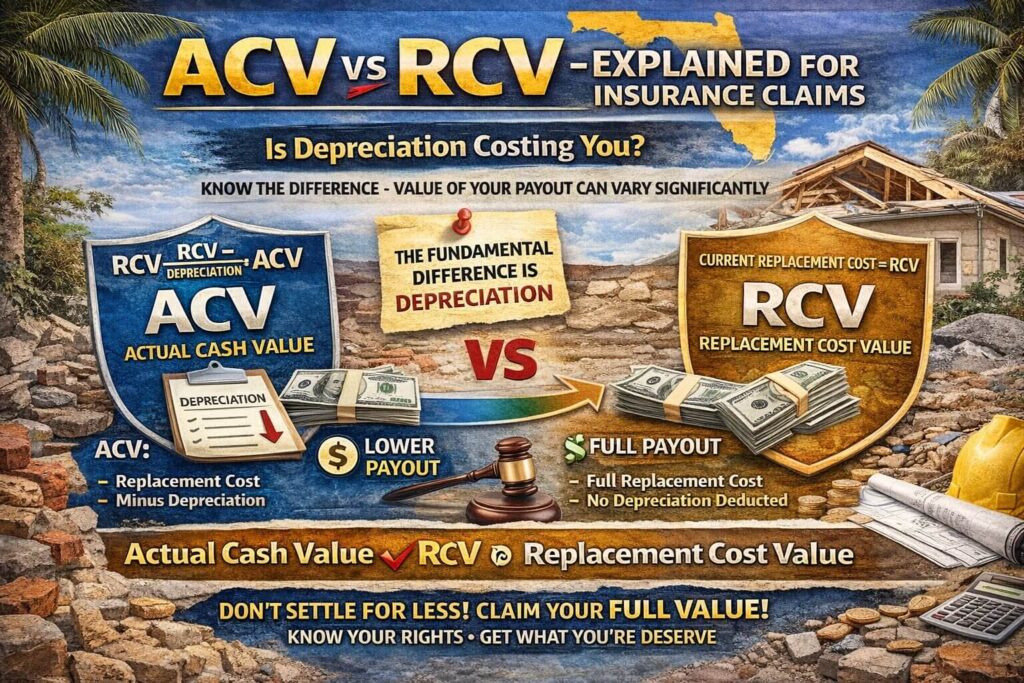

The way an insurance claim gets calculated often matters more than the damage itself. Many homeowners expect their insurance policy to cover the full cost of fixing or replacing what was lost. However, the reality looks very different once terms like ACV and RCV appear on the estimate. This guide explains the real difference between ACV vs. RCV, how insurance companies use these methods, and what Florida property owners can do to protect the value of their insurance claim and understand the difference. What Is Replacement Cost Value in Insurance? Replacement cost refers to the amount of money that’s required to repair or replace damaged property with new materials of a similar kind and quality. In insurance, this method focuses on the current cost of replacing items today, not what they were worth years ago, and is commonly referred to as replacement cost insurance. When a policy provides replacement cost coverage, the goal is restoration. The damaged roof, flooring, cabinets,...

Will Homeowners Insurance Cover Roof Leaks? | Everything You Need to Know

A leaking roof is every homeowner’s nightmare. It can lead to costly damage, disrupt your daily life, and leave you wondering: Will homeowners insurance cover roof leaks? The answer isn’t always straightforward. In this article, we’ll break down when roof leaks are covered, common limitations in policies, and how a public insurance adjusting firm can help you maximize your claim. Does Homeowners Insurance Cover Water Damage From a Leaking Roof? Homeowners insurance typically covers water damage caused by roof leaks—but only under specific circumstances. Most policies include coverage for “sudden and accidental” damage, such as: However, water damage due to neglect or wear and tear is generally excluded. For example, if your roof leaks because it hasn’t been maintained, you may find yourself asking, Will homeowners insurance cover roof leaks caused by age? The answer is usually no. 💡 Pro Tip: When filing a claim, take photos of the damage immediately and document any steps taken to prevent further water intrusion. Need help...

Roof Leak Insurance Claim: Maximize Your Compensation with Expert Help

When dealing with a roof leak insurance claim, the process can feel overwhelming, especially for homeowners and business owners in hurricane-prone areas like Florida. Ensuring you receive the compensation you deserve requires expertise, persistence, and a clear understanding of your policy. That’s where PICC (People’s Insurance Claim Center) steps in as your trusted advocate. Understanding Roof Leak Insurance Claims Roof leaks often result from unpredictable events like hurricanes, tropical storms, heavy rain, or hail. These leaks can cause significant secondary damage, including mold growth and structural compromise. Filing an insurance claim for roof leaks can be challenging, as insurers may try to undervalue your claim or deny it outright. Common Questions About Roof Leak Claims: How PICC Simplifies the Claims Process PICC specializes in helping homeowners and business owners maximize their compensation for roof leak damage. Here’s how we make the process easier for you: Why Choose PICC for Your Roof Leak Insurance Claim? When you partner with PICC, you benefit from: Types...