The way an insurance claim gets calculated often matters more than the damage itself. Many homeowners expect their insurance policy to cover the full cost of fixing or replacing what was lost. However, the reality looks very different once terms like ACV and RCV appear on the estimate.

This guide explains the real difference between ACV vs. RCV, how insurance companies use these methods, and what Florida property owners can do to protect the value of their insurance claim and understand the difference.

What Is Replacement Cost Value in Insurance?

Replacement cost refers to the amount of money that’s required to repair or replace damaged property with new materials of a similar kind and quality. In insurance, this method focuses on the current cost of replacing items today, not what they were worth years ago, and is commonly referred to as replacement cost insurance.

When a policy provides replacement cost coverage, the goal is restoration. The damaged roof, flooring, cabinets, or personal belongings are valued based on what it takes to replace them now. No deduction is applied for age, wear, or prior use. This approach is often described as replacement cost value or RCV.

In practical terms, RCV coverage gives homeowners a path to full repair without absorbing large out-of-pocket expenses that are tied to aging materials, regardless of whether those materials were still functional before the loss.

What Is Actual Cash Value (ACV)?

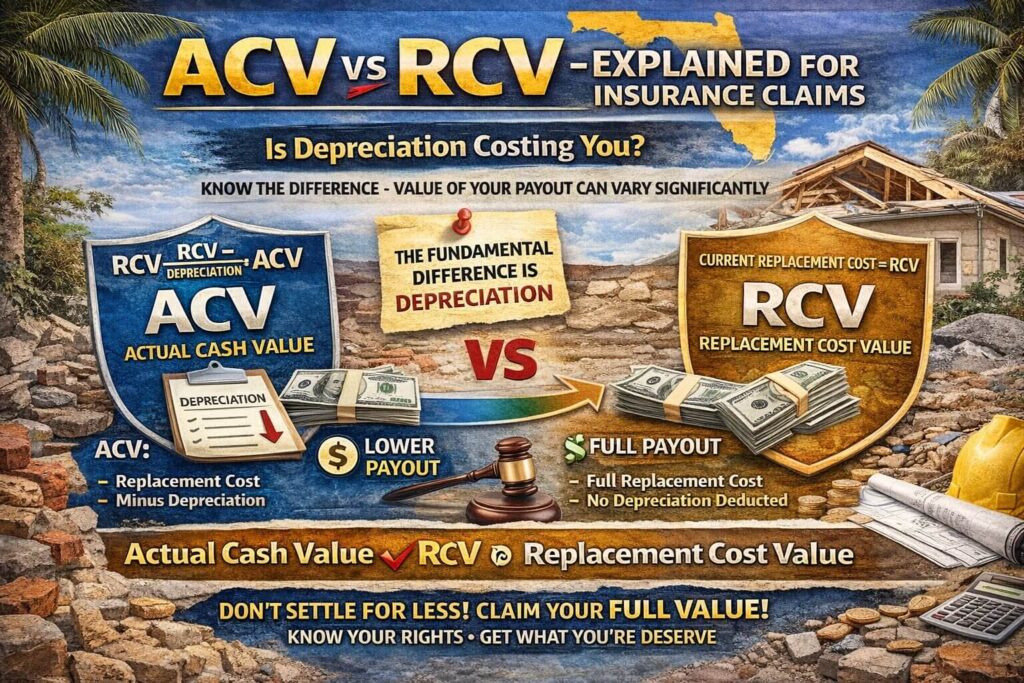

Actual cash value, often shortened to ACV, measures what damaged property was worth at the time of loss. This method starts with the replacement cost value and subtracts depreciation. The result reflects age and condition, and not replacement needs.

The standard formula is simple. Actual cash value equals replacement cost value minus depreciation.

Under an ACV vs RCV policy, ACV almost always produces a lower payout. A roof, appliance, or interior finish that has been in place for years is treated as depreciated, even if it was well-maintained. The insurance company pays that reduced cash value minus the deductible.

This difference is rarely emphasized during the policy purchase process, where coverage is often described in more generic terms rather than explained in terms of how they actually receive their claims. Many homeowners first encounter this distinction after a loss, not when buying homeowners insurance.

Replacement Cost vs Actual Cash Value: Key Differences

The core difference between replacement cost and actual cash valuation comes down to depreciation. RCV focuses on restoring what was damaged, while ACV focuses on past use.

With replacement cost value, the insurance payout aligns with the real cost to rebuild or replace. With cash value, the payout reflects market value after wear and tear, which increases sharply as materials age and the expected lifespan is reduced.

This difference between actual cost and depreciated value can mean tens of thousands of dollars in lost coverage on major claims, especially when roofs, kitchens, or large structural losses are involved.

How Insurance Companies Use ACV to Lower Claim Payments

In many insurance policies, ACV allows carriers to reduce claim payments by applying depreciation before repairs begin. Depreciation schedules are not fixed, which gives adjusters discretion to assign percentages based on age, materials, and internal guidelines.

Because higher depreciation percentages directly lower the amount paid on a claim, this discretion often works in the insurer’s favor without reflecting the actual condition of the property.

Older roofs, flooring, HVAC systems, and wiring are common targets. The insurance company estimates the cost to replace the item, subtracts depreciation from that amount, and issues payment on the reduced value rather than the cost of repair. That reduction shifts the financial burden to the homeowner.

This practice appears often in RCV and ACV insurance disputes, particularly after storms or water damage.

Depreciation in Insurance Claims Explained

Depreciation represents the loss of value over time due to age and condition. In theory, it reflects real-world wear, but in practice, it often becomes aggressive.

Items that still function well may be treated as near the end of their useful life, because depreciation is often calculated using an assumed lifespan rather than actual condition. Some insurance estimates apply depreciation evenly without considering maintenance, upgrades, or material quality.

Once depreciation is applied, the actual cash value paid can fall far below the amount needed to repair or replace the damaged area.

When Insurance Should Pay Replacement Cost Instead of ACV

Many homeowners insurance policies require insurers to pay replacement cost once the damaged property has been repaired or replaced and proper documentation is provided. Until that point, carriers often issue an initial payment based on ACV, withholding depreciation.

After repairs are completed and documented, the insurer should release the remaining balance to reach the full replacement cost. Problems arise when insurers delay, deny, or quietly close files before that second payment occurs.

Knowing whether a policy allows ACV or RCV settlement, and what conditions must be met to trigger replacement cost payment, makes a major difference in timing and total payout.

Common Claim Types Where ACV Is Misused

ACV disputes tend to appear in the same types of claims because depreciation is easiest to apply where materials age on paper but still function in real life.

- Roof damage after storms

- Water damage affecting cabinets, flooring, and drywall

- Fire losses involving personal property

- HVAC and plumbing failures

- Mixed home and auto or casualty insurance events

In each of these scenarios, depreciation reduces the cash paid on the claim while the real cost to repair or replace the damaged property remains the same.

How Much Money Homeowners Lose Due to ACV Settlements

The financial gap between cash value and replacement cost widens as a property ages, because depreciation increases while repair costs continue to reflect current market pricing.

Interior materials often depreciate even faster. Flooring, cabinets, and finishes may lose value on paper despite being permanently attached and functional before the loss. When these items are damaged, the ACV payment frequently falls far short of what is required to restore the home.

Across Florida, this pattern leaves homeowners paying out of pocket for repairs they believed were covered. A policy can appear adequate when reviewed in advance, yet the actual cost value paid after depreciation tells a very different story once a claim is filed.

Can a Public Adjuster Convert ACV to Replacement Cost?

A public adjuster reviews the insurance policy, carrier estimates, and the full scope of damage to determine whether replacement cost coverage applies to the loss. In many cases, claims are initially handled as ACV because required documentation or repair estimates were incomplete or narrowly scoped.

By re-evaluating depreciation assumptions, confirming which components qualify for replacement cost under the policy, and preparing detailed repair estimates that reflect current market pricing, a public adjuster can establish the conditions required for RCV payment. This often includes documenting all completed repairs or demonstrating that full replacement is necessary.

When this information is presented correctly, the claim can move from an ACV settlement to replacement cost treatment to trigger payment of withheld depreciation. This process frequently results in additional funds that were not disclosed or addressed by the carrier’s insurance agent or staff adjuster.

What to Do If Your Claim Was Paid as Actual Cash Value

- Review your insurance policy and claim payment explanation

Look for references to ACV or RCV, withheld depreciation, and any deadlines tied to repairs or supplemental claims. This confirms whether additional payment may still be available. - Check how the loss was valued

Identify whether the insurer applied depreciation before repairs and whether the settlement reflects actual cash value. - Obtain repair estimates based on the current market cost

Estimates should reflect what it will take to repair or replace the damaged property today, not a depreciated value. - Document all repairs and related expenses

Keep records of invoices, materials, completed work, and communication with the insurer. This documentation is often required to recover withheld depreciation. - Avoid closing the claim too early

Accepting final payment or closing the file can limit the ability to pursue additional funds later. - Seek professional guidance if the numbers do not align

Reviewing policy language, depreciation applied, and claim deadlines can show whether additional payment is still available and prevent coverage from being lost due to missed timelines.

Get a Second Review of Your Insurance Claim

Understanding how ACV and RCV affect claim payments is useful only if it leads to the right next step when a settlement falls short.

If your insurance claim was settled using actual cash value and the payment does not reflect the true cost to repair your property, a second review may still be worth pursuing.PICC FLA works with Florida property owners to review insurance claims, identify missed replacement cost value, and address improper depreciation. A careful claim review can clarify whether additional benefits remain available under your insurance policy.