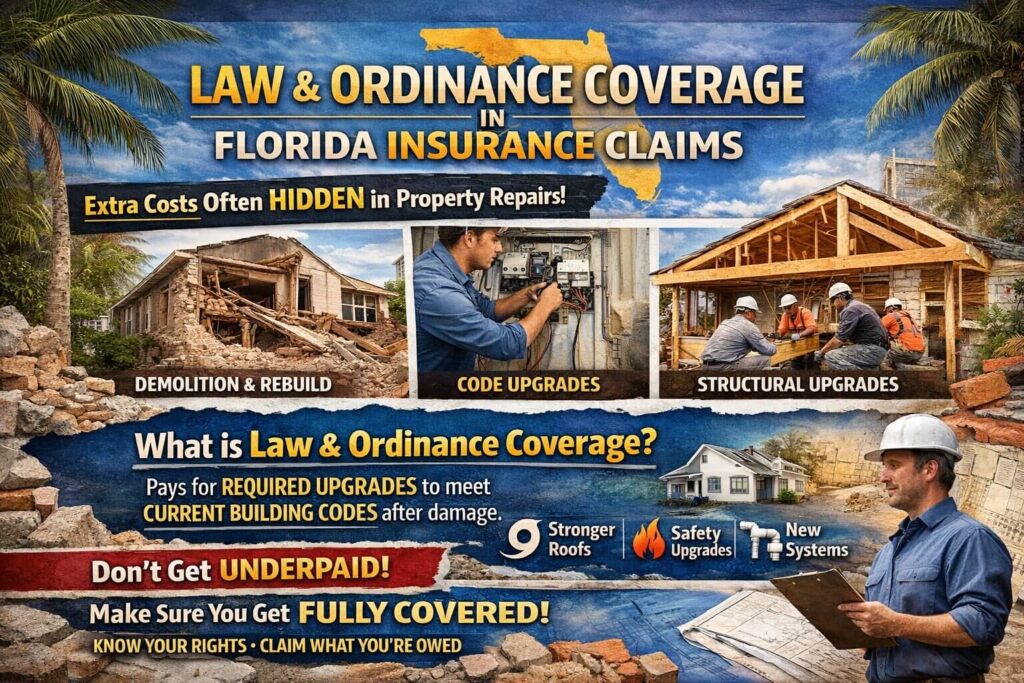

Property damage in Florida rarely ends with visible repairs. Once walls are opened or roofs removed, another layer of expense often appears. Why? Building rules can change, or even local requirements may get involved. That is where law and ordinance coverage Florida becomes part of the insurance claim process, and where many payouts fall short.

This coverage is written into many property insurance policies, yet we often see it overlooked or underpaid. For homeowners and property owners struggling with seriously damaged property, that oversight can entail thousands of dollars in additional costs that should have been covered.

What Is Law and Ordinance Coverage in Insurance?

Ordinance or law coverage is part of property insurance that pays for extra costs required by current building rules after damage occurs. In Florida, the focus is on compliance. Repairs must follow today’s laws and codes, not the standards in place when the property was built.

In practical terms, this coverage applies when a damaged structure must be repaired, rebuilt, or altered to satisfy modern building codes and standards. Even sections of a property that were not physically damaged may need demolition or reconstruction. Those expenses fall under law coverage, not basic repair coverage.

Many policyholders ask how law and ordinance coverage in Florida works because it activates only after a covered loss, and only when code requirements increase the scope or cost of work. In simple terms, it does not behave like standard insurance coverage.

Why Ordinance and Law Coverage Matters in Florida

Florida faces hurricanes, flooding, fires, and wind damage every year. As a result, building codes are frequently updated to improve safety and resilience. Florida law also gives strong authority to local governments to enforce those codes during repairs.

This creates a gap. A property insurance policy may pay to fix what was damaged, yet rebuilding to current standards often costs far more. Law and ordinance coverage Florida exists to bridge that gap.

Without it, homeowners insurance may stop short of covering the full rebuild. For older homes and commercial buildings, the difference can be severe. New roof fastening systems, impact-rated openings, electrical upgrades, and structural reinforcements all carry additional expenses.

How Florida Building Codes Affect Insurance Claims

Many property owners only discover ordinance or law issues after an estimate arrives. If your claim includes partial demolition, expanded scope of work, or references to code upgrades without corresponding payment, ordinance, or law coverage may already apply.

Florida adopts new statewide codes on a regular cycle, and counties add their own local ordinances. After major damage, inspectors review the entire structure. If repairs exceed a certain threshold, compliance with current codes becomes mandatory.

That review often reaches areas untouched by the original damage. Insurance companies often treat these expenses as optional or excluded. In reality, the Florida law requires compliance once work reaches certain levels. The cost follows the law, not the insurer’s preference.

What Law and Ordinance Coverage Typically Pays For

This coverage applies to three broad categories.

- Demolition that’s required by current building codes

- Rebuilding work that’s needed to meet today’s standards

- Added upgrades that are required by rules that did not exist at the time the property was built

These items often include structural reinforcements, updated wiring, plumbing changes, elevation adjustments, and fire- or wind-mitigation features. In many claim cases, the undamaged portion of the property drives a large share of the total cost.

What’s more, as these expenses arise from legal requirements, they fall outside the scope of standard repair payments. The law and ordinance insurance coverage in Florida addresses that difference.

Why Insurance Companies Often Exclude Law and Ordinance Costs

Most insurance companies separate basic damage repairs from code-driven upgrades. Adjusters may classify ordinance-related expenses as betterments, owner responsibility, or non-covered improvements.

Another issue involves limits. Law and ordinance coverage usually carries a percentage cap that is tied to the dwelling or structure value. If the private insurer never applies that portion, the policyholder never reaches those policy limits.

This practice leaves many claims underpaid. The coverage exists, yet it remains unused unless someone identifies and documents it properly.

Common Claim Situations Where Law and Ordinance Coverage Applies

Hurricane roof losses often expose framing that no longer meets current codes. Fire damage may trigger full electrical replacement. Water damage in older properties may require plumbing changes across multiple rooms.

Commercial property insurance claims face similar problems. Mixed-use buildings, warehouses, and retail spaces must meet modern accessibility, fire, and structural rules during repairs. In each case, ordinance or law coverage becomes central to the claim outcome.

These situations typically involve layered costs tied to legal compliance.

How Law and Ordinance Coverage Can Increase Your Insurance Payout

When applied correctly, this coverage shifts costs from the property owner back onto the insurance policy. That shift often increases the payout because these expenses are not included in standard repair estimates.

A focused review looks at current building codes, required demolition, and work affecting undamaged portions of the structure. Without that review, insurance companies often pay only for visible damage and exclude legally required upgrades.

For homeowners, this difference determines whether repairs stop short or restore the property in ways that comply with local codes.

Signs Your Law and Ordinance Coverage Was Overlooked

Signs of missed law and ordinance coverage usually appear in the claim paperwork. Insurance estimates that restore damaged areas but ignore required code upgrades often signal a problem. The same applies when demolition or rebuild work is excluded for adjacent or undamaged portions of the structure.

Silence is another indicator. If ordinance or law coverage is never mentioned in the insurer’s explanation, it may not have been evaluated at all. Many insurance policies include this coverage by default, yet it is frequently left out of the claim file.

In underpaid claims, the issue is the failure to apply coverage to code-driven work.

When law and ordinance costs are involved, a claim or policy review with PICC Fla can help identify coverage that may have been overlooked. Contact us for more information.

Can a Public Adjuster Recover Law and Ordinance Costs?

Yes. A public adjuster recovers law and ordinance costs by identifying code-required work that was never included in the insurer’s estimate. In Florida claims, this often involves demolition, required upgrades, and repairs tied to undamaged portions of the structure.

Insurance companies frequently exclude these items because they are not broken out separately or tied clearly to policy language. When building code requirements, repair scopes, and costs are documented together, that portion of the claim must be reconsidered.

In complex property claims, this process often results in payment for compliance-driven work that was previously denied or ignored.

What to Do If Law and Ordinance Coverage Is Denied or Ignored

When law and ordinance coverage is denied or ignored, the issue often lies in how the claim was evaluated, not in the policy itself. In Florida claims, insurers frequently exclude code-driven work by labeling it as an upgrade or owner responsibility.

A close review compares the insurance estimate against current building codes and local ordinances. Any required work missing from the scope signals a gap in the coverage application. Compliance during reconstruction is mandatory, regardless of whether the insurer accounted for it.

When payment is refused without a clear policy basis, claim representation becomes necessary to reopen that portion of the loss and pursue the costs tied to legal requirements.