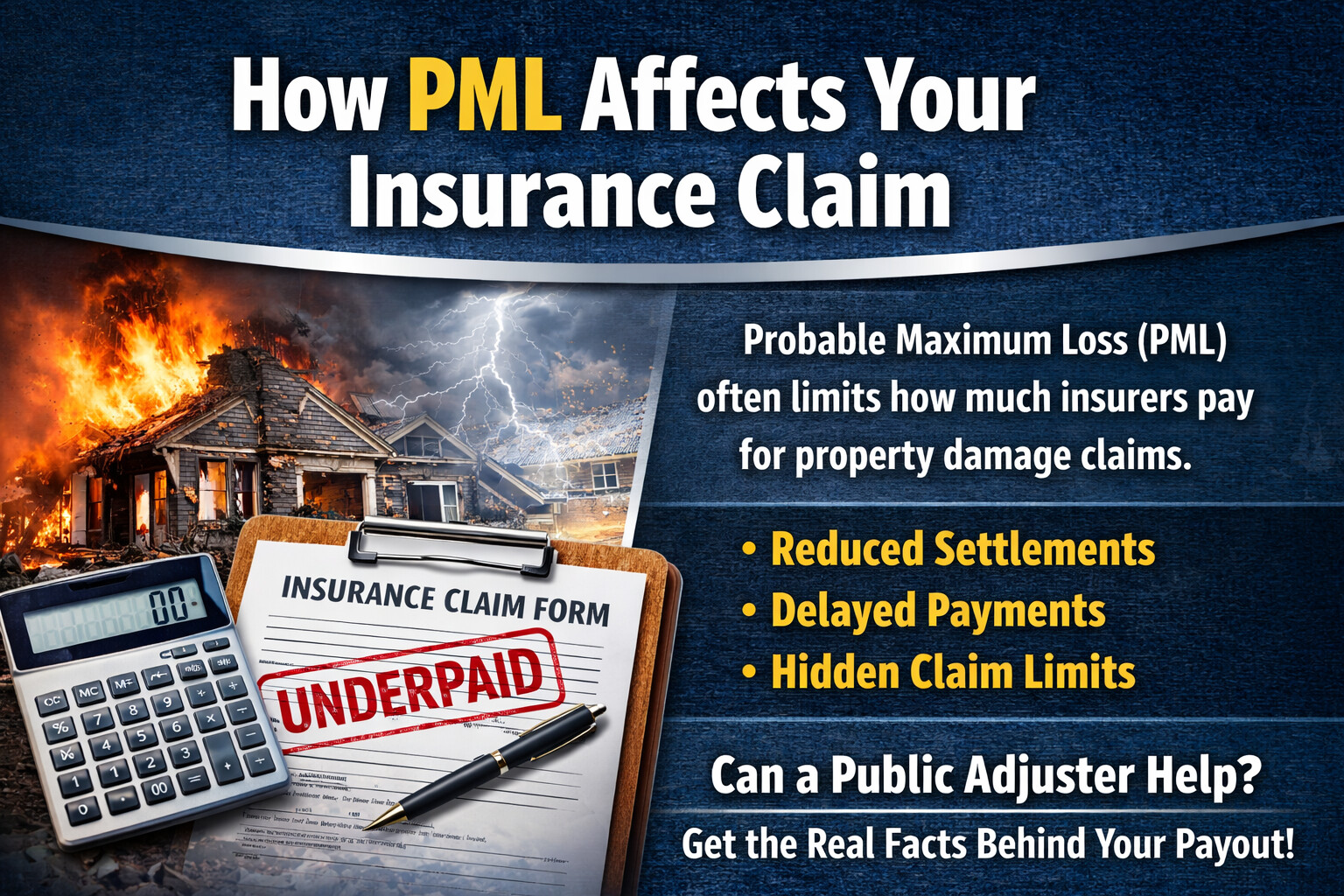

Property damage should lead to a fair payout. Yet many policyholders find that their settlement stalls or shrinks once the insurer introduces a term they may have never heard before. This term is no other than PML, which stands for Probable Maximum Loss. Even though the policy might promise protection, the insurer’s internal calculation of potential maximum loss affects how much money they are willing to compensate. For many property owners, especially those who are involved in real estate, the probable alignment between actual damage and what the insurer considers acceptable risk turns into a silent factor that affects the entire claim.

When you understand how PML works in practice, you begin to see why many property damage claims end up underpaid and why a public adjuster often becomes necessary.

What Does PML Mean in Insurance?

The PML insurance definition is highly linked with the insurer’s attempt to estimate the greatest loss they believe they would have to pay under normal conditions. The PML full form in insurance refers to probable maximum loss, a figure that’s set by underwriters long before a claim ever occurs.

And interestingly, when you ask what PML stands for in insurance, the answer seems simple, but its impact is anything but huge. Insurers review the property’s construction, location, fire protection, maintenance records, and hazard exposure. They merge these factors with historical data, risk assessments, and internal modeling grounded in engineering and science to arrive at a number they believe represents their maximum exposure. That number shapes underwriting decisions, premium levels, and later, the claim outcome. Many policyholders never see this figure, yet it sits in the insurer’s system and quietly limits the direction of your claim right from the start of the claim process.

How Insurance Companies Use PML in Claims

When a damage claim is opened, the insurer compares your loss to the PML they calculated long before the damage occurred. This internal number becomes the limit of what they expect to pay. If your actual loss exceeds it, the insurer slows the claim down. As a result, reserves are kept low, payments are delayed, and the adjuster suddenly requires approval for even small amounts.

Every time you submit new documentation, they push back because approving it would mean that they have to raise their reserve above the PML benchmark. Engineers may be assigned to justify keeping the loss within that number. Nothing about these delays is accidental. For the insurer, the PML functions as a control mechanism that shapes how fast you get paid and how much they are ultimately willing to offer.

Engineers may be assigned as a means to keep the loss within that number. For the insurer, PML acts as a risk mitigation tool, as it protects their financial exposure far more than your right to full compensation.

How PML Influences Reserve Decisions Behind the Scenes

Adjusters open a claim by checking the reserve amount that was created from the insurer’s earlier PML calculation. That internal figure sets a financial ceiling long before anyone looks at the actual damage.

A loss that appears higher than that ceiling triggers slowdowns inside the company in multiple ways: emails go missing, authorizations pause, and even supplement requests stay untouched. Supervisors step in to avoid raising the reserve beyond the number already in place. The adjuster’s authority shrinks, and every estimate you submit is questioned because accepting it would push the loss above the PML benchmark stored in their system. All those delay tactics and reversals feel random to the policyholder, yet they follow a clear pattern tied directly to an internal number the insurer refuses to disclose, even when the physical damage indicates otherwise.

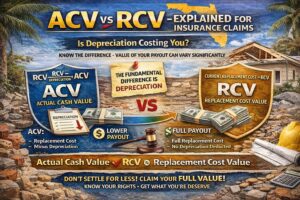

PML Vs. TIV Vs. Actual Loss

Confusion often escalates when an insurer uses technical language that sounds familiar, but acts differently.

- PML in insurance is an insurer’s internal calculation of likely exposure.

- TIV represents the total insurable value of the property, often used in real estate valuation. This number reflects the cost to rebuild or replace the entire structure.

- Actual loss is the physical and financial impact after the event occurs.

Problems arise when the insurer relies on PML instead of TIV or actual documented damage. When the internal number sits lower than the real cost of recovery, the insurer may insist that the loss falls below their expected loss limits.

Understanding PML in business terms can explain this conflict. Insurers aim to manage risk to protect their capital, while policyholders aim to restore their property. The two interests do not always align, and PML often becomes the dividing line between what the insurer wants to pay and what the property owner demands, particularly when the PML is lower than the maximum foreseeable loss or the true foreseeable loss of the damaged property.

When PML Is Used in Insurance Claims

PML becomes more influential in large or complicated claim cases. Fire losses in commercial buildings, hurricane damage to multi-unit properties, and flooding in industrial facilities oftentimes trigger internal reviews where underwriters revisit their probable maximum loss calculations.

The use of PML in insurance decisions increases when the insurer believes the event is a threat to reserves or when they fear the damage might exceed internal expectations. In many cases, the carrier brings in engineers to determine whether the loss fits within the existing PML. This process slows progress and creates a narrow path for settlement and disputes, especially when the loss involves structural damage, mechanical systems, or business interruption.

Can a Public Adjuster Challenge PML?

A public adjuster who works on behalf of the policyholder can challenge PML by presenting evidence that the insurer’s internal estimate does not match the real damage. This often involves bringing in independent evaluators, gathering detailed documentation, and demonstrating that the insurer’s probable maximum loss was based on incorrect assumptions.

A public adjuster evaluates the actual condition of the structure, the deterioration caused by the event, and the cost that is required to restore the property damage. When the insurer relies too heavily on PML or misapplies estimated maximum loss benchmarks, a public adjuster exposes the gap between internal modeling and real-world conditions. PICC FLA handles these disputes frequently, especially when the carrier’s modeling ignores hidden damage, structural compromise, or long-term impact on mechanical and electrical systems.

Signs Your Claim Is Underpaid Due to PML

Many policyholders suspect something is wrong but cannot identify the cause.

- A claim that remains stagnant for weeks usually reflects a reserve problem that’s tied to the insurer’s PML ceiling.

- When an adjuster downplays clear structural or interior damage, they’re often restricted by internal authority limitations.

- Repeated requests for documents that the insurer already received can be a delay tactic to avoid raising reserves.

- Sudden reversals in the insurer’s stance or unexplained reductions in approved repairs often show they are working to keep the loss inside the PML figure.

- A visible gap between real damage and the insurer’s estimate implies the claim is being filtered through a hidden financial limit rather than evaluated accurately.

What to Do If PML Is Used Against Your Claim

The first step is to recognize that you are not bound by the insurer’s internal calculations. PML has to do with risk management, not the actual condition of your property. A policyholder has the right to present their own scope, estimates, and independent expert assessments. When the insurer relies on internal PML and ignores the real cost of repairs, a public adjuster can bring clarity.

The adjuster represents and fights for your interests. By documenting the full impact of the event and demonstrating the true cost of restoration, a public adjuster counters the preset limitations the insurer has placed on your claim.