PICC Florida Blog - Page 2

Will Homeowners Insurance Cover Air Conditioner? Your Guide to Understanding HVAC Coverage

Does Homeowners Insurance Cover HVAC and AC Units? Homeowners often ask, Will homeowners insurance cover air conditioner damage? This question depends largely on the specifics of your policy, the type of air conditioning system in question, and the cause of the damage. Generally, homeowners insurance will cover air conditioner units if the damage results from certain covered events, such as fire, theft, or severe weather. This guide will help you understand what’s typically covered, common exclusions, and effective strategies for filing an AC-related insurance claim. What Does Homeowners Insurance Cover for HVAC Systems? Homeowners insurance may cover your air conditioner if it is damaged by a covered peril like fire, lightning, or certain types of storm damage. Typically, built-in HVAC systems fall under dwelling coverage, while window or portable units are usually classified as personal property and may have different coverage terms. Does Homeowners Insurance Cover HVAC Unit Damage? Insurance may cover HVAC damage if it’s sudden and accidental. For example: However, wear and tear,...

Milton Hurricane Roof Damage Insurance Claim Services

Maximize Your Milton Hurricane Roof Damage Insurance Claim with People’s Insurance Claim Center (PICC) When it comes to filing a Milton Hurricane Roof Damage Insurance Claim, the process can be overwhelming and complicated, especially after experiencing the devastating impact of a hurricane. At People’s Insurance Claim Center (PICC), we specialize in assisting Milton, Florida homeowners and business owners to navigate this process and maximize their Milton Hurricane Roof Damage Insurance Claim. As public adjusters with over 30 years of experience, PICC is dedicated to securing the compensation you deserve by representing your interests—not the insurance companies’. Our team, composed of licensed adjusters, forensic accountants, contractors, and attorneys, provides comprehensive support to ensure a seamless claims process. Discover how PICC can be your advocate in the wake of Milton Hurricane Roof Damage Insurance Claims, helping you secure a favorable outcome and restoring your property to its pre-storm condition. Why Choose PICC for Your Hurricane Roof Damage Claim in Milton? As a...

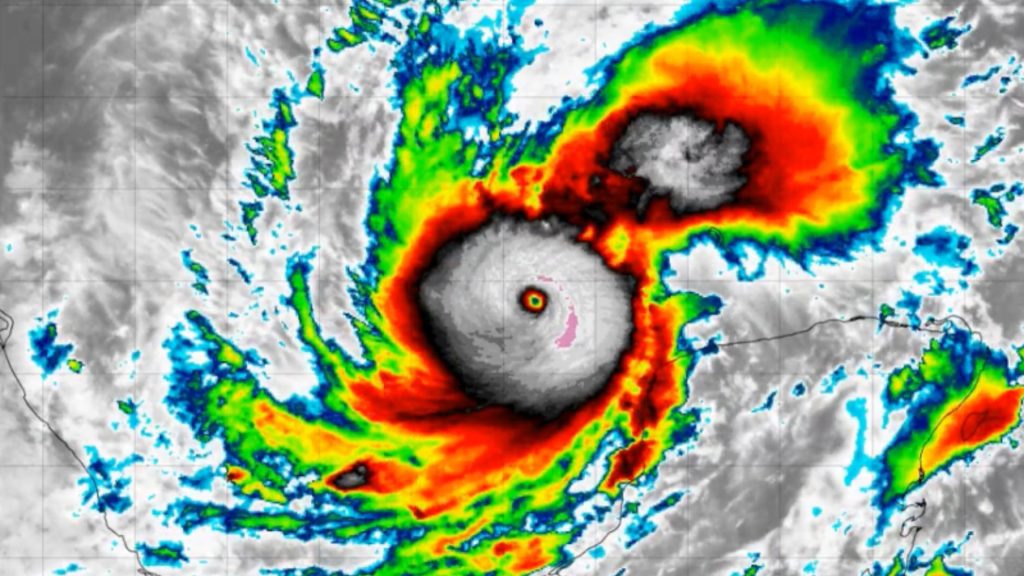

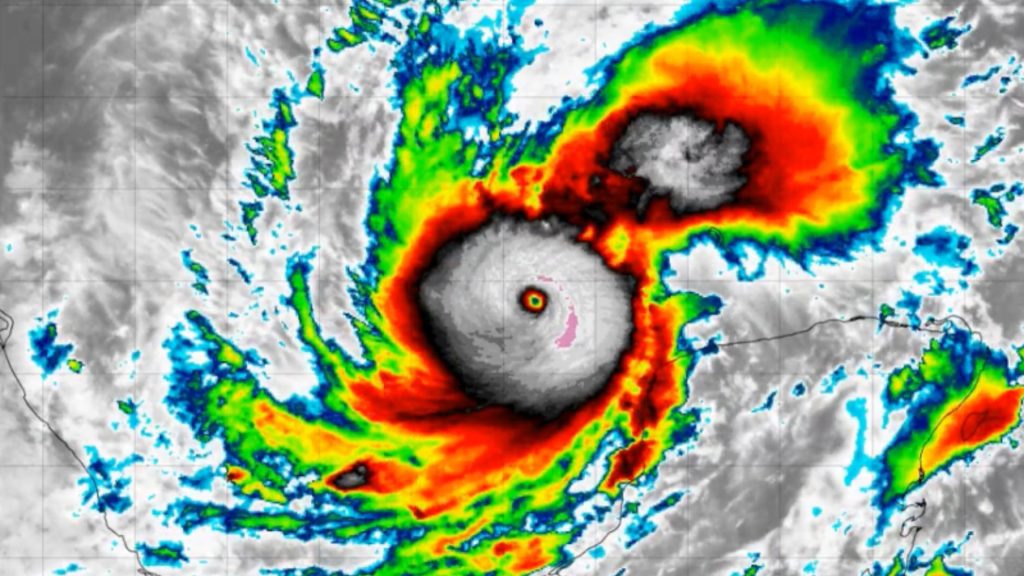

Hurricane Milton Threatens Florida: A Comprehensive Guide to Prepare, Stay Safe, and Recover (UPDATED)

Hurricane Milton, a powerful Category 4 storm with 130 mph winds, is churning towards Florida’s Gulf Coast, posing a significant threat to the Tampa Bay region. Landfall is anticipated Wednesday night, and residents are preparing for what could be the most potent hurricane to impact the area in over a century. This comprehensive guide offers crucial information about Hurricane Milton, including preparedness tips, safety measures, potential property damage, recovery advice, and how to navigate insurance claims with the help of public adjusters like PICC. Understanding the Threat of Hurricane Milton Current Status and Projected Path Hurricane Milton has rapidly intensified into a major hurricane, currently categorized as a Category 4 with sustained winds reaching a staggering 130 mph. The storm’s projected path indicates a direct hit on the Tampa Bay area Wednesday night, raising serious concerns due to the region’s vulnerability to storm surge and the fact that it hasn’t faced a hurricane of this magnitude since 1921. While the...