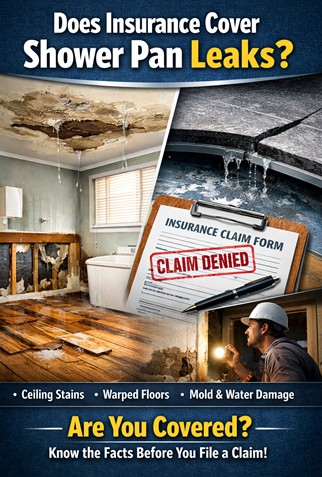

You usually don’t discover a shower pan problem during a routine inspection. You find it when something already feels wrong. Maybe it’s a stain that begins to spread across the ceiling below the bathroom, or the floor near the shower feels soft underfoot. This type of damage is often linked to hidden moisture. And that specific moment you realize you need to contact a plumber or a contractor as soon as possible, because the damage you’re dealing with doesn’t look small.

The insurance process suddenly feels intimidating. Most people have never experienced a loss like this before, yet decisions made in the first few days can significantly impact the outcome of the insurance claim. That is why the question comes fast and with urgency: Are shower leaks covered by insurance? The answer exists, but it is not a simple one, especially when dealing with property insurance.

Why shower pan failures create serious damage

A shower pan sits beneath the finished tile surface and works as the waterproof barrier that directs water toward the drain. Traditional systems rely on liners beneath sloped mortar beds, while newer installations may use prefabricated pans or liquid-applied membranes.

When that barrier fails, the leak remains hidden. Water does not spill onto the bathroom floor; it escapes below the surface, out of sight. This type of leak can develop slowly, while, in general, leaks can remain unnoticed for long periods of time.

Over time, movement in the structure, clogged weep holes, improper slope, or installation defects can cause moisture to travel beneath the pan. Once water leaves the shower assembly, it spreads sideways through subfloor seams, joist bays, and wall plates.

Because this process happens slowly and invisibly, damage continues long before anyone realizes there is a problem. Ceilings often stain first, flooring swells later, and mold and water damage begin forming behind walls.

By the time signs appear, the affected area isn’t limited to the shower itself, and repairs often extend beyond what homeowners expect.

Are Shower Pan Leaks Covered by Insurance?

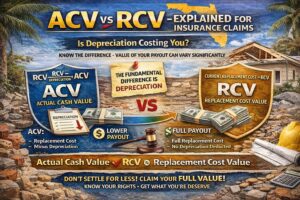

In most cases, home insurance does not cover the pan itself. Insurance companies typically classify cracked liners, failed membranes, or deteriorated materials as maintenance-related problems under property damage insurance.

That does not automatically mean the claim can be denied. The critical distinction lies between what failed and what was damaged afterward. When water escapes beyond the shower system and enters surrounding materials, the loss changes in nature. A shower pan leak covered by insurance refers to the structural and interior damage caused by the escaping water, but not the pan itself.

What Damage May Still Be Covered

Once water migrates outside the shower assembly, it affects materials never designed to absorb moisture.

In many insurance policies, coverage applies to the resulting water intrusion rather than the failed component, which is often the most expensive part of the loss.

When that distinction is overlooked, homeowners are left paying for repairs that may have been eligible under their insurance policy.

Because a shower pan failure often leads to hidden moisture beyond the bathroom itself, many of these losses fall under broader water-related types of claims. In these situations, working with a licensed public adjuster who is experienced in water damage claims can ensure all affected areas are properly identified and documented. Learn more about how PICC FLA handles these cases on our Water Damage Claims Adjuster page.

Why Insurance Companies Deny These Claims

Insurance companies reject shower pan leak claims for a few specific reasons under the law and policy interpretation.

- Most homeowners insurance policies exclude damage caused by wear, deterioration, or repeated seepage over time. When moisture escapes beneath a shower pan, insurers often classify the loss as continuous rather than sudden and accidental.

- Another common issue is the date of loss. As the leak is hidden, insurers may argue that the damage existed long before it was discovered, which places it outside the period of coverage.

- Insurance adjusters may also limit coverage when they believe the source of water didn’t originate from plumbing, but from a broken building component. In these cases, it’s the pan that becomes the focus point, not the surrounding structural damage.

For homeowners, this may seem confusing. The damage appears all at once, yet the decision is based on how the loss is classified. This is clearly the case where a clear explanation is replaced by technical policy language.

What to do immediately after discovering a shower pan leak

When water damage appears inside a home, the natural instinctive reaction would be to fix it immediately. Still, slowing down the process can protect you and prevent further damage. What you should do instead:

- Stop using the shower right away. Ongoing water flow allows moisture to migrate deeper into the structure, increasing damage and dispute risk.

- Limit further exposure. Dry visible moisture and maintain airflow to reduce saturation.

- Document everything you can see. Staining patterns, warped flooring, loose tiles, and ceiling discoloration can help establish the condition of your property at the time of discovery.

- Avoid permanent repairs before inspection. Temporary mitigation is appropriate, but full demolition can remove all necessary evidence that will support damage insurance claims.

How a public adjuster helps with shower pan claims.

Public adjusters represent the policyholder, not the insurance company. Their role is to inspect the damage, prepare estimates, and manage communication throughout the entire insurance claim process.

They inspect the property in person, track moisture migration, and document affected materials that are often overlooked during brief carrier inspections.

When damage is properly identified and presented, the pan leak claim stands on clearer ground, and the hopes for a positive outcome are higher.

Free Inspection & Policy Review with PICC FLA

PICC South Florida public adjuster represents homeowners and business owners throughout Florida for water, plumbing, burst pipes, fire and smoke, wind, hurricane, and theft losses.

Every loss is different. That is why PICC FLA offers a free inspection and an opportunity to review your policy before you make any decisions that can impact your finances and peace of mind.

There are no upfront fees. If there is no recovery, there is no fee.

If you don’t know whether to file a claim, a professional review can bring clarity before accepting a denial or reduced payment that may not reflect the actual property damage.

Call us today to schedule a free consultation.